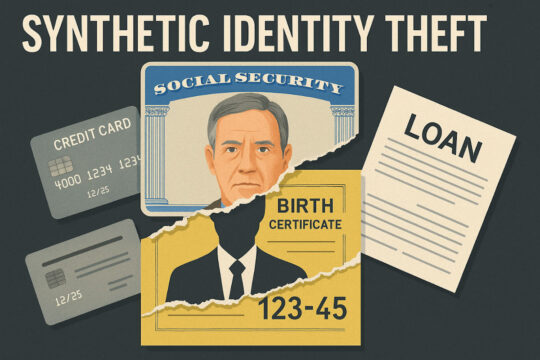

Why your credit freeze isn’t enough to stop identity theft

A credit freeze blocks new accounts, but it won’t alert you when criminals open bank accounts or take out payday loans in your name. Kim Komando explains why layers of protection are the only way to save yourself 300 hours of cleanup stress.